CHRONICLING THE 2011 SUMMER SELLOFF: SAMPLES FROM THE ARCHIVES

THURS 4 August 2011 5PM EST

Have you ever tried to catch a falling knife, before it hit the ground?

Walking in the 'Shoes of ProtectVest,' you won't have to.

You're covered... protected at the Dow 12,600 equivalency basis!

Regarding tomorrow, let's see exactly what type of Echo from today's North American selloff arises in Asia later this evening, and then in Europe in the morning.

ProtectVest by EchoVectorVest.

"This week, we've certainly been watching out for you."

FRI 5 August 2011 4AM EST UPDATE

On Tuesday 2 August 2011 at 12:50PM EST ProtectVWST issued a STRONG Portfolio Insurance Continuation ALERT which included the following:

"Insurance Application Continuation Alert

The major market's failure to sustain its gain through 10AM EST and its subsequent selloff through12PM EST signaled 10AM EST as the daily top and triggered a significant 2QEV pivot reversal in the major market, which signals further price erosion and likely penetration of support.

This very significant 2QEV pivot at work does not portent well for major market prices, particularly for potential price action and EV price parities during the QEV frame of the first three weeks of September, via March and June EVs...

ProtectVest Strongly Recommends keeping full portfolio insurance recently applied at $126, DIA Equivalency Basis, in full force.

*EV: EchoVector

*QEV: Quarterly EchoVector

*2QEV: Six-month EchoVector

*EV, QEV, and 2QEV are Trademarks of EchoVectorVest, A Division of Motion Dynamics and Precision Pivots

ProtectVEST by EchoVectorVEST

"We're keeping watch for you."

Wednesday's and Thursday's severe downside price action in the US large cap major market composite indexes reflects the significant price pressure pivot that was detected by the MDPP Forecast Model and Alert Model Tuesday before 1PM.

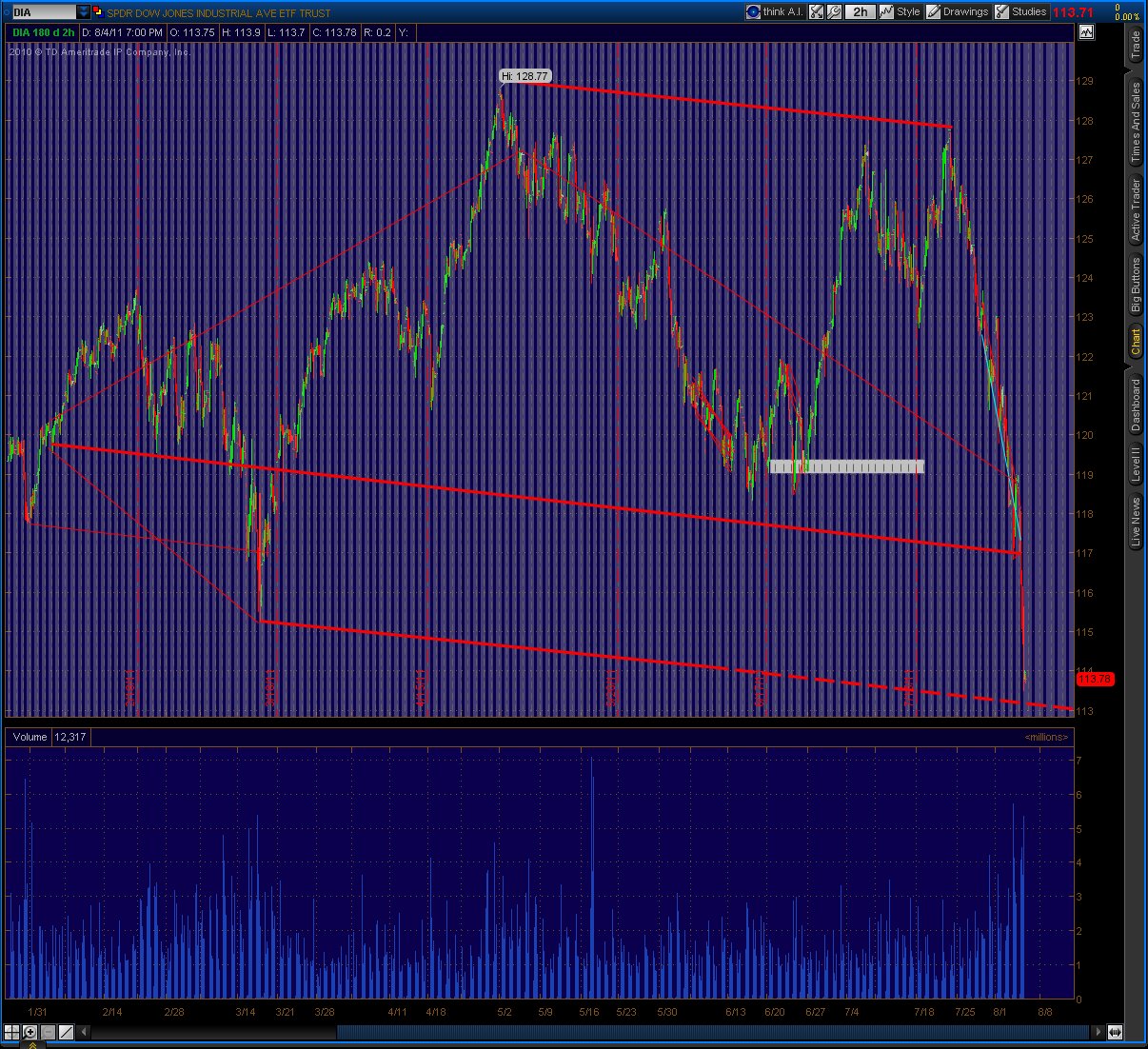

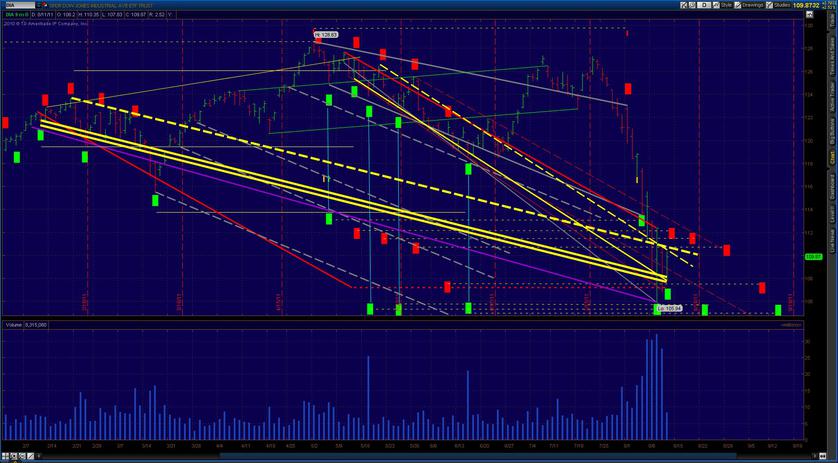

Below is a GuideChart of the DIA (in 180-day+, 2-hour, OHLC price increments) including regular pre-market and post market trading hours, which illustrates and highlights the key QEV and 2QEV currently at work.

FRI 5 AUGUST 2011 AT 11:45AM EST UPDATE

The markets have weakened into morning lows after selling off further in Asia and then trying to rally in the mixed European and American pre-market period earlier this morning.

The upside rally attempt this morning is consistent with the relative strength going into today and early next week on both the QEV and the 2QEV.

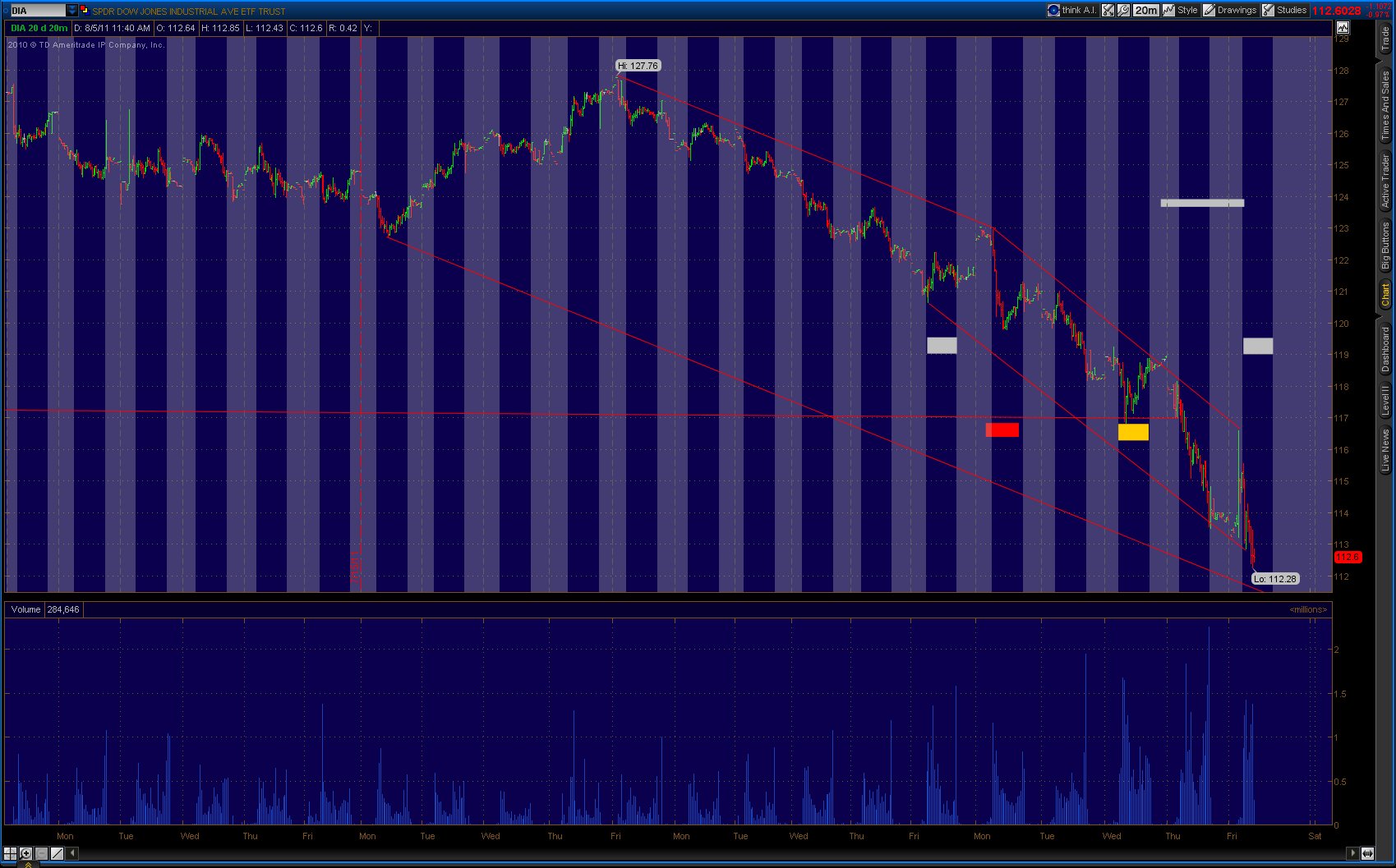

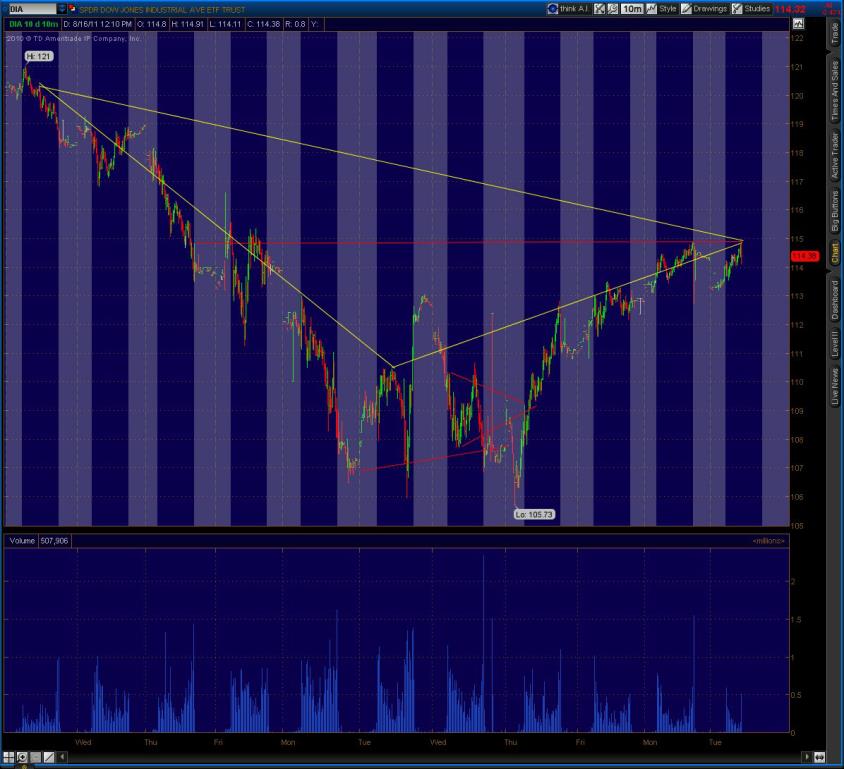

MDPP anticipates some resistance to further downside along the channel bottom of the 2 week channel top vector formed and illustrated in the EasyGuideChart below.

Extending the channel bottom vector from this coming Monday's '3 weeks ago' backdate (when the last sustained short-term three day rally started) through today's timeframe will yield an 'end day price equivalency low' (EDPEL) on the DIA for today at about $111.30.

Therefore, hitting this price level anytime before the close today can generate more convicted 'oversold buying interest.' This can potentially build into the start the EchovectorVest MDPP forecast of possible short-term multi-day recovery strength found, and seen, in the prior Friday QEVEBD (QuarterlyEchoVectorEchoBackDate) and the prior Friday 2QEVEBD (2QuarterlyEchoVectorEchoBackDate).

UPDATE Monday 8 August 2011 630AM EST

Have you ever tried to catch a falling knife, before it hit the ground? Walking in the 'Shoes of ProtectVest,' you won't have to. You're covered... protected at Dow 12,600, Equivalency basis! That's at 1260 on a /YM Equivalency Basis!

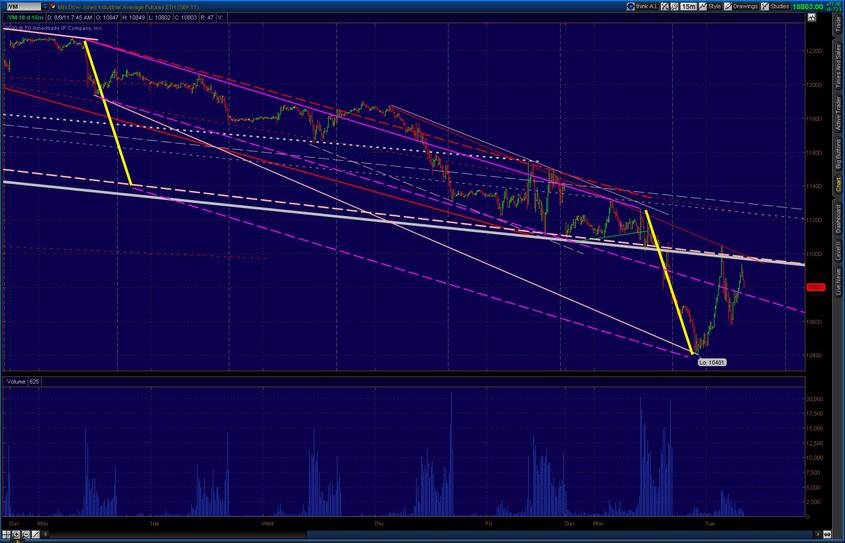

In the MDPP EasyGudeChart below for the Dow 30 mini-futures, the/YM, notice the overnight selloff back to the Friday's morning lows in the US markets. Alse Note the weekly Friday EV's for each week going back the last 30 days. Upweek EVs are in green, and downweek EVs are in red. The monthly EVBackEcho (EVBE) off this past Friday's low is in grey. It's forecast top limit is in grey-spaced.

Purple lines (appearing a bit too similiar to grey in this dasplay), are the recent and significant 'downchurn channel suppor't vectors. Also included are their 'downside backframed support' vectors, in purple-spaced. These critical trading vector references help frame price action.

This morning ProtectVest sees the 1100 to 1200 area as an important trading range today, and 1150 today as key support area going into tomorrow's trading for upside action. Failing this does not portend well into tomorrow's...

Monday 8 August 2011 1:30PM EST UPDATE

The markets, on a /YM basis, have traded essentially in the 1100 to 1200, and then back again to 1100, range through this morning, as forecast early this AM by EchoVectorVEST MDPP. See prior Update.

This ProtectVEST EVV MDPP forecast enabled 'potential trade capture' on 'the long side' between 1100 to 1200, and then trade capture again on 'the short side' between 1200 and 1100, on the /YM equivalency basis, intraday. This amounts to almost 2% trade capture potential.

The /YM is at the lower range at the time of this update's constution. and is now showing signs of weakening past support after trading in this range. The expectation is a 'break through' of this support to new lows.

The historic S&P downgrade issued over the weekend of US Debt Creditworthiness has eclipsed any rebound strength that may have come early this weak. Global markets are reacting poorly to the downgrade. This augurs poorly for US markets as they approaches further typical seasonal weakness in later August.

The prior week's red WEV (Weekly EchoVector) and the most recently established STTCV (Short Term Trade Channel Vector), in peach, are therefore still in force and play. This will become pronounce if we break through downtrending monthly EV support (WEV), in grey.

Monday's have shown considerable weakness the past month, over the prior Friday, on downtrending weeks.

UPDATE Tuesday 9 August 2011 7:45 AM EST /YM Basis

Good Morning (to those of you who could arise from bed after yesterday's mini-Black Monday). As mentioned in the yesterday's last posting at 1:30 PM EST, the market looked ready to push down through further significant support, and it did. And, also as mentioned yesterday, the market has tended to seek post-Friday Monday lows this last month. In overnight and early morning trading in Asia and Europe the market has already 'mean reverted' back to the MonthlyEchoVector (MEV), in grey, and the Quarterly Downtrend Mean (established from the Top at the beginning of week of May), in dotted red. A further look at the WEV (WeeklyEchoVector) now active since yesterday's new bottom was reached will give more insight (and probably indicate some 'shaving weakness' to come off of the overseas recovery bounce highs, before going into today's North American market open). "We're keeping watch for you."

/YM Basis: The WEV is in purple. The yellow lines indicate the WEV Monday 930AMEST morning beginning dropoff starting points. Note how overseas trading tried to bring prices back close to par on the Tuesday WEBD (WeeklyEchoBackDate) basis, and with Monday's MEV (MonthlyEchoVector) in solid grey (when extended into the week).

It is our opinion some 'price shaving' and from these overseas recovery level highs, will occur, at a minimum, in the American market and early-premarket in the morning before any real move forward could be mustered.

TUES 9:15AM EST Supplemental UPDATE: The market was shaved, by about 2 and a half point on a DIA equivalency basis from the overseas recovery highs, but is otherwise holding up nicely. This may help set up price action forward going into Thursday's FTP (focus time period) WEV potential weakness.

UPDATE Tuesday 9 August 2011 9:50AM EST

As forecasted, The DIA 'shaved prices' at the American Market Open to the WEV of Tuesday 7:45am EST. If the market can find support there this morning hour, like yesterday, intermediate morning prices should bounce back again within the 9:30 DEV (DailyEchoVector) established TradeChannel (TC). The market must hold its SupportVector (SV) off yesterday's bottom or face another possible recurrance of yesterday afternoon's price action, but, within today's overall DEV tradechannel. All of this can lend some possible relative short-term stability (RSTS) to the market today within these new ST (short-term) tradingbands (TBs, STTBs), going into Thursday's FTP.

Yesterday the SV was not held into the afternoon, and the MEV started to fail also (after lunchtime) going into 1:30pmest.

"We're keeping watch for you"

UPDATE Tuesday 10PM EST 9 AUGUST 2011

Well, as we all know by now, 'Uncle Ben' came to the rescue this afternoon as we started to falter once again against the upside resistance formed by the precipitious WEV and MEV generated (and in full force) by this week's very weak price action.

So, charging in came 'Uncle Ben,' to shore up and help protect his 'weath effect' solution' (to the 'lingerings' of this past recession' on many measures), a solution in which the Fed is now so heavily vested.

'Why just print money (additional accounting units) and then have Uncle Sam inject them into the economy, when you (Uncle Ben) can also 'jack up the numerical values of the already existing units 'across the board' (that is, the board 'held by the 50% of Americans so established therein -the stock market- who also happen to be the Americans who tend to 'vote' politically, economically, and financially on 'so very many levels,' and 'who also manage' so many 'significant pieces' of the broad American Landscape.) Easpecaily when you can do this with 'simple disclosure and verbal injection.'

So, the head of the 'American Financial Priesthood' came out and levitated up the stock market, yet again...

To help rescue his vulnerable and endangered solution.

Interestingly, it should also be noted that, when, as an institution, you are 'so very vested in, and seemingly banking on" a particular solution to a problem, then perhaps that solution begins to own you; that is to say, your success is now dependent upon that solution working out for you.

In other words, Uncle Ben may have put inself in the position of now needing to do what the market likes, and will then also reward him with up levitation compliance for doing for it. Which then, is really in control? This may, or may not, be the best 'box' for the Fed to have put itself into.

Regardless, upon Uncle Ben's verbations this afternoon, came the desired market re-verberations... (Formal knowledge of theories in acoustics and harmonics lend well to understanding certain aspects market behavioral mechanics.) Short-Term Market Mogels were pleased and said, 'I do like ever higher quant accounting units' in my portfolio, and 'thanks for not squeezing the interest (rate) out of me', and duly responded by bidding back up prices, and then 'broke through' the 'above mentioned resistance' (just as needed) this afternoon, and then ran the stock market right on up to the short-term forecast top of the MEV.

(See this Morning's Earlier update.)

Thanks for the extra stimulus, and umph, Uncle Ben. "Braking' many of 'those shorts' who are seemingly 'not buying' your 'solution', stimulating an effective ST 'short-sqeezing' rally (as these shorts also add to buy pressure in order to 'cover' their 'short positions' is a nice move. In comes buying pressure 'from both sides', and a nice leg up too.)

The ST forecast top area of the MEV is taken from the MEVMBDsWT (MonthlyEchoVectorMonthlyBackDateWeek'sTop), and is illustrated by the grey-spaced line paralleling above the grey MEV line illustrated in the MDPP EasyGuideForecastChart (EGFC) presented in the EASYGUIDETRADECHART above (in the UPDATE at 1:3PMEST today).

And of course, all of this effect is not just generated within the MDPP Forecast Model and Alert Paradign, but is surely all generated also within the Fed's own 'massively capable crank' too.

Thanks Uncle Ben. Especially from the Gold wonks.

"We're keeping watch for you"

PS. Someone once sang,"Catch a wave and your sitting on top of the world, catch a wave, catch a wave." So, let's see just how long and far this FED-sent wave pushes (in the wake of other economic realities) before it too starts to recede. We may want to be ready to again reverse our boards when it does. (Or at least 'insure our good position', effectively hoping out of the water at that good price capture for a while.)

Is the emporer wearing cloths? Has the Head of the Financial Levi really any enduringly effective cloth here? ProtectVEST presently questions the soundness of banking on it. There is more going on than simple Fed money flush.And yet we are watching closely, because it's also usually a questionable thing to fight the FED; except, perhaps, right before, and into, a Presidential-election year.

But here it can also be argued that today's Fed's disclosure/verbal action' was simply meant to slow down an 'otherwise seemingly dangerously accelerating composite stock price level deterioration, at the margin.. And not to necessarily try to reverse it. (Acceptable levels at acceptable times under certain conditions having already been baked into the cake.)

Which is also a much different kind of FED fight itself to be 'currently positioning a stock portfolio in' over the coming quarter...

Remember: The second half of August is often not easy on the market... and then there is also September.

UPDATE Tuesday 9 August 2011 1:30PM EST

As forecasted.

"We're keeping watch for you"

SUPPLEMENTAL UPDATE TUE 8:30AM EST 10 August 2011: Regarding short-term downside trend. See the QEV Wave Pattern Signal Guide and significant EBDs (EchoBackDates) and ETDs (EchoTradeDates) by clicking on the EASYGUIDECHART Button in header above.

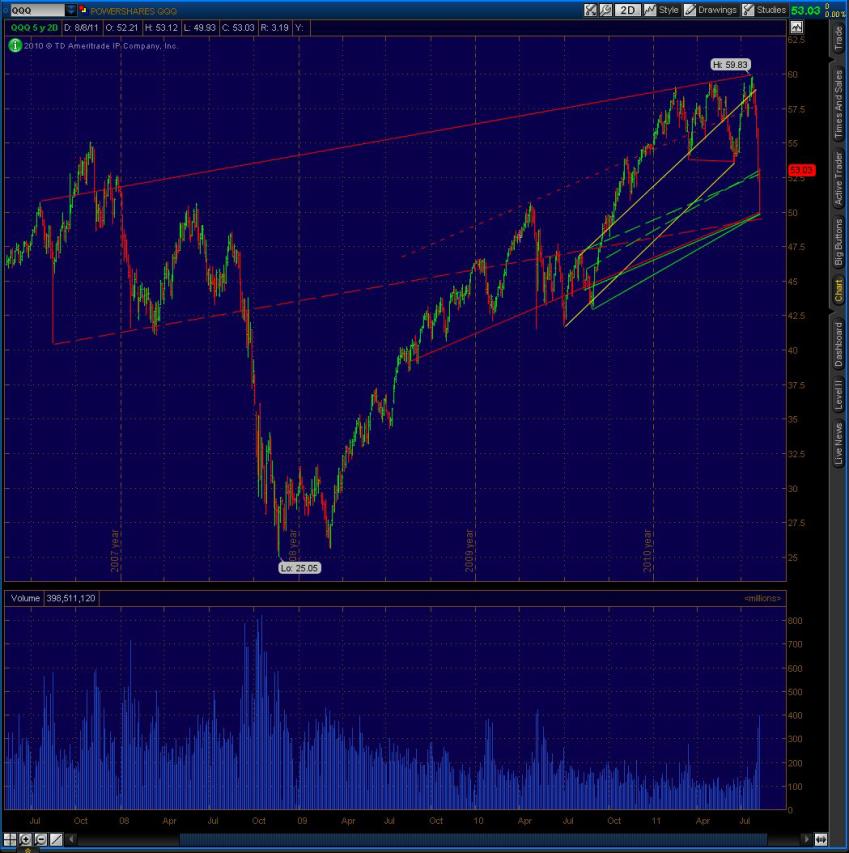

QQQ AEV (Annual EchoVector)

QQQ 2AEV, CCEV (Two-year EchoVector, Congressional Cycle EchoVector)

QQQ 4AEV, PCEV (Four-Year Echovector, Presidential Cycle EchoVector)

Again, regarding the short-term downside trend, See the 7-Month Wave Pattern EasyGuide TradeSignalChart with the significant and highlighted EBDs (EchoBackDates) and forwardly implied ETDs (EchoTradeDates) by clicking on the EASYGUIDECHART Button in header above. It indicates that significant EchoDerived (ED) downside pressure (DP) may remain on a short-term (ST) timing basis. The QQQ EVV MDPP EasyGuideCharts above also illustrate how any movement higher from yesterday's closing price levels may also be premature and out of phase on AEV, CCEV, and PCEV timing bases.

UPDATE 8PM EST Wednesday 10 August 2011

Finally, a true financial news report on what is really going on, and what is really is in, and has actually been driving, the machines and professional tradestations and management architectures and bulk of analysis these last dozen years...

http://finance.yahoo.com/news/Chartbased-trading-behind-big-apf-1691830324.html?x=0&sec=topStories&pos=4&asset=&ccode=

Do you and your RIA have your CRAYs ready?

http://www.cray.com/home.aspx

http://en.wikipedia.org/wiki/Cray

Or, are you still a computational and information processing world behind, and basically using 'polished up and pinstriped Crayolas'...

ProtectVest by EchoVectorVest can help.

We're keeping watch for you"

A Trader's EDGE MDPP EasyGuideTradeChart of the /YM, (the DOW 30 Industrials mini-futures, which is traded 24 hours a day, the Two-Day One-Minute Timeframe, with overnight trading in Asia and Europe included) is provided below.

The solid red vector highlighted is the DEV (Daily EchoVetor) for yesterday's and today's open. Once this DEV is established, see the then instantly generated Forecast DEV's in red-spaced working through the day today...

The solid blue vector is the DEV PriceDownSide Pivot that occurred (DEVPDSP). You can see it also instantly generates a Forecast PDSP DEV forward off the today's 11AMEST hour 'European Market Close' low highlighted in blue-spaced.

The peach vectors are some key price action top and bottom vectors (PATV, PABV). They instantly generate Forecast PAV's which are peach-spaced highlighted.

This is the Power of EchoVectorVEST by MDPP...

We capture and aggregate the 'technical drivers' evidently working within all these 'CRAYs' that are operating within the market....'

Showing your their true colors!

ProtectVest by EchoVectorVest

"We're keeping watch for you."

UPDATE Sunday 14 August 2011 6PM EST

Follow-through on Thursday's uptrend came in nicely in the morning and into European market closing hour (11-12 PM EST))

Then relative weakness in momentum consistent with the 2QEV and QEV EBDs came in nicely, as forecast, as well. Of the 5 block red EBD's in this phase of the QEV and 2QEV backwaves, the last 2 red block periods remain the most significantly inhibitive to any near-term price level recovery back to prior trading ranges.

UPDATE Tuesday 16 August 2011 7:45AM EST

The market continued its price stabilization, holding up. Although, it is trading already trading in the upper 2ND level recovery price range area, the EVV look (or 'focus') is for QEV and 2QEV EBD signal weakness to occur this week, likely in the second half of the 2ND half, and coming in more precisely around option expiration. These two ensuing red-block two-periods (about a week each), present the most significant challenge to the price recovery off recent lows, which could also potentiially and in part, help contribute to a related ACTIONABLE ALERT becoming generated within the MDPP Forecast Model.

An additionally forecasted move in ST Gold price re-strengthening came in yesterday. (See GOLD Button)

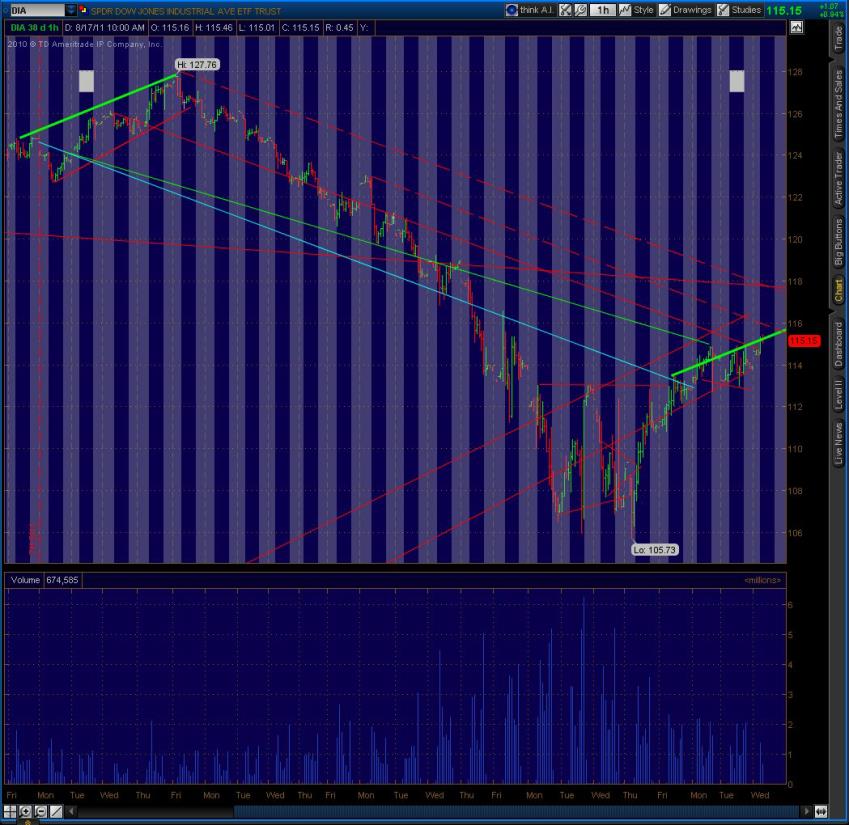

UPDATE WED 17 AUG 11 11AM EST

Shopping for the Near Term Top with a focus on the DIA EchovectorVEST MDPP MEV.

SEE price area around $116. We are in the yellow caution time/price zone.

SEE EasyGuideWaveSIGNALChart in EASYGUIDECHARTS

EasyGuideChart: DIA Equivalency Basis. We have entered the QEV 2QEV ETD caution area, highlighted by the yellow horizontal bars.

TODAY'S TOMORROW

By EchoVectorVEST MDPP PRECISION PIVOTS

"We're keeping watch for you"

Again, regarding the short-term downside trend, See the 7-Month Wave Pattern EasyGuide TradeSignalChart with the significant and highlighted EBDs (EchoBackDates) and forwardly implied ETDs (EchoTradeDates) by clicking on the EASYGUIDECHART Button in header above. It indicates that significant EchoDerived (ED) downside pressure (DP) may remain on a short-term (ST) timing basis. The QQQ EVV MDPP EasyGuideCharts above also illustrate how any movement higher from yesterday's closing price levels may also be premature and out of phase on AEV, CCEV, and PCEV timing bases.

UPDATE Friday 12 August 2011

Yesterday's forecasted relative strength and bounce came in nicely: See the forecast green block for yesterday in the EchoVectorVEST MDPP EasyGuide Wave Pattern Signal Charts located above and below. Below is timeframed late yesteday morning and shows the daily QEV and 2QEV in yellow highlighted also. After trading at bit higher, in the afternoon, we closed out basically on the yellow-spaced forecast intersects.

TODAY'S TOMORROW

By EchoVectorVEST MDPP PRECISION PIVOTS

"We're keeping watch for you"

12:30PM EST TUESDAY 16 August 11

ALERT: DEV PRECISION PIVOT

At 12:29PM EST MDPP issued a DEV MDPP PRECISION PIVOT ALERT indicating a significant potential trend reversal challenge to the recovery uptrend from the earlier AUGUST lows is now in EFFECT. LONG Position covering at 114.25 to 115 on the DIA equivalency basis from the 106 lows earlier in August is now SUGGESTED. This pivot was also preceeded today by the obtainment of a KEY MDPP QEV price level INTERSECT and fullfilment.

ProtectVEST by EchoVectorVEST

"We're keeping watch for you."

2:15AM EST WEDNESDAY 17 August 11

ALERT UPDATE: PRIOR DEV PRECISION PIVOT REVERSAL PIVOT OCCURANCE ALERT

This UPDATE Negates Yesterday's DEV PRECISION PIVOT ALERT

At 2:10 AM EST an MDPP DEV PRECISION PIVOT REVERSAL PIVOT in the globally traded /YM (DIA ETF mini-futures) occurred in overseas trading. This DEV PRECISION PIVOT REVERSAL PIVOT negates the effect of the DEV MDPP PRECISION PIVOT occurance on the DIA and the MDPP Alert issue the preceeding day.

ProtectVEST by EchoVectorVEST

"We're keeping watch for you."

DISCLAIMER

This post is for information purposes only.

There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS.

There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS will be achieved.

NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person.

Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we strongly recommend you first consult with you personal financial advisor.

ProtectVest and AdvanceVest by EchoVectorVest, Divisions of Motion Dynamics and Precision Pivots,

Bradford Market Research and Analytics

Currently A FREE Educational, Forecast Opinion, and Forecast Methodology and

Related Strategies Discussion Resource and Forum

TODAY'S OUTLOOK

FOR TOMORROW

From ProtectVEST and AdvanceVEST

BY EchoVectorVEST MDPP

PRECISION PIVOTS

For The Most Recently Updated EchoVector Pivot Point Analysis FrameCharts

And Active Advanced Management OTAPS-PPS GuideMaps

__________________________________

Click On:

__________________________________

And Click On:

"We're keeping watch for you"

UTILIZING

The S&P 500 /ES Futures

The Dow 30 Industrials /YM Futures

Nasdaq 100 /NQ Futures

The Gold Metals /GC Futures

The Silver Metals /YI Futures

The Light Sweet Crude Oil

/QM and /CL Futures,

The Treasury 10 Year

/TY Futures

And Additional Currency, Commodity, and Emerging Market Futures

And Many Proxy And Associated ETFs

- Asian Market EchoVector

- European Market EchoVector

- Daily EchoVector

- Weekly EchoVector

- 2 Week EchoVector

- Monthly EchoVector

- 2 Month EchoVector

- Quarterly EchoVector

- 2 Quarters EchoVector

- 3 Quarters EchoVector

- Annual EchoVector

- Congressional Cycle (Bi-Annual) EchoVector

- Presidential Cycle EchoVector

- Regime Change Cycle (8 Years or Less) EchoVector

- 2 Regime Change Cycles EchoVector

- 3 Regime Change Cycles EchoVector

- 4 Regime Change Cycles EchoVector

- 2X4 Regime Change Cycles EchoVector

*THE P&A BY EVV MDPP PRECISION PIVOTS MODEL TERMINOLOGY

- ASM-MEV

- EUM-EV

- DEV

- WEV

- 2WEV

- MEV

- 2MEV

- QEV

- 2QEV

- 3QEV

- AEV

- CCEV

- PCEV

- RCCEV

- 2RCCEV

- 3RCCEV

- 4RCCEV

- 2X4 RCCEV

PROTECTVEST AND ADVANCVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

" Positionaing for change, staying ahead of the curve, we're keeping watch for you!" - MDPP Precision Pivots

THESE VARIED TIME CYCLE PRICE MOMENTUM ECHOVECTORS CAN UTILIZE CORRESPONDING COMPONENT PRECISION CALCULATED TIME PERIOD INTERVALS OF: 1 MINUTE, 5 MINUTE, 10 MINUTE. 15 MINUTE, 20 MINUTE, 30 MINUTE, HOUR, 2 HOUR, 4 HOUR, 6 HOUR, 8 HOUR, 12 HOUR, DAY, 2 DAY, 3 DAY, 4 DAY, WEEK, 2 WEEK, 3 WEEK, 4 WEEK, MONTH, 2 MONTH, 3 MONTH, 6 MONTH, OR 1 YEAR, DEPENDING ON THE ELECTED ANALYTICAL FRAMEWORK AND PERSPECTIVE CHOSEN.

FOR MICRO EVs, SUCH AS THE 15 MINUTE, 30 MINUTE, 1 HOUR, 2 HOUR, AND 4 HOUR EVs, COMPONENT PRECISION PERIOD TIME INTERVALS CAN BE LESS THAN ONE MINUTE.

TODAY'S TOMORROW ECHOVECTOR ANALYSIS FOCUS FORECAST FRAMECHARTS

AND ACTIVE ADVANCED POSITION MANAGEMENT FORECAST GUIDEMAPS

CALCULATING AND ILLUSTRATING PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS KEY FOCUS INTEREST OPPORTUNITY PERIOD ECHOVECTORS, COORDINATE FORECAST ECHOVECTORS, ECHOVECTOR PIVOT POINT PRICE PROJECTIONS, AND OTAPS-PPS ACTIVE ADVANCED POSITION AND RISK MANAGEMENT TARGET TIME/PRICE POSITION POLARITY SWITCH SIGNAL EXTENSION VECTORS.

ALSO HIGHLIGHTING SELECT TIME-FRAMES, INCLUDING THE KEY ECHOVECTORVEST MDPP PRECISION PIVOTS FOCUS ANALYSIS PERSPECTIVES: European Market EV (5-hours), Asian Market EV (12-hours), Daily EV, Weekly EV, Bi-Weekly EV, Monthly EV, Bi-Monthly EV, Quarterly EV, Bi-Quarterly EV, Tri-Quarterly EV, Annual EV, CongressionalCycle EV (2-year), Presidential Cycle EV (4-year), Federal Reserve Cycle EV (5-year) Senatorial Cycle EV (6-year) Regime Change Cycle EV (Typically 8-years), Maturity Cycle EV (Typically 16-years), Tri-Regime Change Cycle EV (Typically 24-years), Quad-Regime Change Cycle EV (Typically 32-years), AND 2x Quad-Regime Change Cycle EV (Typically 64-years) Perspectives *

Copyright 2011-2022. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. All Rights Reserved.

"Positioning for change, staying ahead of the curve,

we're keeping watch for you!" - MDPP PRECISION PIVOTS

.PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

TUTORIAL ECHOVECTOR ANALYSIS:

FOCUS FORECAST FRAMECHARTS

MODEL-BASED ECHOVECTORS

KEY ECHOBACKDATES AND ECHOBACKPERIODS

KEY OPPORTUNITY INDICATOR COORDINATE FORECAST ECHOVECTORS

RELATED ECHOVECTOR PIVOT POINT PRICE PROJECTIONS

HIGH FOCUS INTEREST OPPORTUNITY PERIODS AND HIGHLIGHTED SCENARIO SETUPS

ACTIVE ADVANCED POSITION AND RISK MANAGEMENT OTAPS-PPS SWITCH SIGNAL VECTORS

HIGH OPPORTUNITY PROXY DERIVATIVE RIDER VEHICLE BASKET CONSTRUCTIONS

ADVANCED ECHOVECTOR ANALYSIS AND COMMENTARY

OPINIONS AND OUTLOOKS --SIGNIFICANT FORECAST OPPORTUNITY PRESENTATIONS

- DOWPIVOTS

- SPYPIVOTS (S&P500)

- QQQPIVOTS (NASDAQ100)

- GOLDPIVOTS

- OILPIVOTS

- BONDPIVOTS

- DOLLARPIVOTS

- CURRENCY PIVOTS

- COMMODITYPIVOTS

- EMERGING MARKET PIVOTS

- ETFPIVOTS

- E-MINIPIVOTS

- MDPP PRECISIONPIVOTS